Feedback from Spring 2007 in pdf format ![]()

The Nova Scotia property tax was originally intended to be a wealth tax. In the society of the late 1800s wealth was often accumulated in the form of property and household possessions. Over time the economy, the real estate market and municipal government have all changed dramatically. The Tax Reform Committee has concluded that the current tax system needs to be modernized.

There is little evidence either that property assessment can easily be made more accurate or that more accurate values would provide for a more logical tax system. Rather, the municipality needs to re-think the foundations of its entire tax system and either base it on the historic principle of wealth and income, on municipal services, some combination of the two or some other basis.

Property Values No Longer Relate to Income or Services

There is no longer a strong connection between ownership of property and wealth or income. Data reviewed by the Committee shows that in 2001 the statistical correlation between income and home values was only 28% out of a possible 100%. New types of mortgages exist and real estate speculation has driven up home prices. Homes are long term investments, while income and ability to pay can fluctuate with changes in employment, family size, the economy and age.

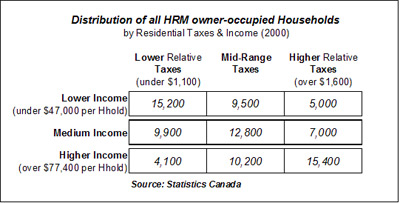

A review of 2001 census data from Statistics Canada found that about 50% of those in low-value homes had medium or high incomes and that about 45% of high-value homes were owned by those with low or medium incomes. See a summary of the census data, below.

Nor is there a strong connection between municipal services and property taxes. There are many factors other than municipal services with a greater influence on property prices. This has led to the frequent complaint that values have risen and services have stayed the same.

The Property Tax System has become less Equitable

The Property Tax System Needs to Be Economically Competitive

Over the next 25 years Halifax is expected to see significant growth in its population. The Regional Plan was designed to support the growth of compact development. Municipal services can be provided more efficiently to larger multi-unit buildings (such as condominiums and apartments) than to less dense forms of housing. However, a municipal tax system based on property values does not recognize this. As such, there are variations in the tax burden on homes, apartments and condos that are at odds with the Regional Plan. Apartments are currently ineligible for the assessment cap, meaning there will likely be a gradual shift in the tax burden towards apartment units.

One of the biggest areas of concern relates to the functioning of the assessment cap. When a home is sold it reverts back to its market value and the assessment cap limits start over again. Newer homes or homes being sold (i.e. losing protection of the assessment cap) will have higher taxable values than other homes. Over time this will lead to a shift in the tax burden for such homes with serious impacts for the real estate market and hence economic growth.

The Deed Transfer Tax has also been a barrier to individuals seeking to purchase homes. As with the general property taxes, there is no strong connection to either services or income. The Committee is concerned that it will be a significant barrier to many young people purchasing a home.